Composition your spending plan so that you continue to be on top of loan payments to be certain your business winds up more powerful plus more lucrative once the equilibrium is paid off.

Optimum loan quantity via Chase differs by job but is often as much as $12.5 million. An SBA rate relates to the CDC part of the loan, and an origination cost may possibly apply to our part of the loan.

You draw cash from the road in the form of unique loans.‡ With a few strains of credit, like American Express® Business Line of Credit history, you might have more than one superb loan at 1 time, up towards your accredited line dimensions.

Our Program will function with banking companies and credit rating unions to notify them to this opportunity and encourage engagement and uptake of our Software.

This getting claimed, Even though the composition of this type of SBA loan could possibly be a lot more advanced plus the cash can only be employed for pretty precise purposes, it’s an extremely competitive funding Answer for businesses looking to acquire or update property, machines or machinery. Due to this, SBA 504 loans will often be equated as SBA industrial housing loans.

Reap the benefits of a revolving line of credit rating that helps you to independent business costs, track buys additional competently, decrease paperwork through versatile billing possibilities and cover unexpected charges.

Doing the job Cash loans are granted to help fund day by day operational jobs for businesses of all dimensions.

The Nevada Loan Participation Plan will buy a percentage of a loan from your participating lender or credit rating union. The percentage of the loan ordered by our application will perhaps Have got a lower charge of fascination that will hence reduce the overall fascination burden.

Performance cookies are applied to be familiar with and review The main element effectiveness indexes of the website which helps in offering an even better user working experience for your website visitors. Analytics Analytics

Secured loans demand collateral to back up the quantity of the loan, that means you might eliminate Anything website you place up in case you fall short to pay in complete.

By way of example, in the event you’re intending to use a SBA 504 loan to get, renovate, or change an present developing, it need to be at the very least 51% proprietor-occupied. Hence, should you have been buying a building with five Business office Areas, you would probably be capable to hire out two of Those people Areas though occupying the remaining a few Areas.

Obtaining reported that, desire prices can even now vary from lender to lender. As a result, the first thing to look for when comparing SBA lenders is curiosity rate and small business loan APR.

Therefore, many of the phrases and fees you’ll see in relation to this SBA loan application (which we’ll talk about through this tutorial) refer precisely towards the CDC percentage of the loan.

They need to make sure that their investment decision results in advancement inside a firm to ensure they are often certain of repayment.

Mason Gamble Then & Now!

Mason Gamble Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Shane West Then & Now!

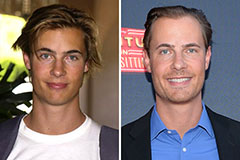

Shane West Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!